The New Gold Standard: Introducing the Robinhood Gold Card

Robinhood set to host first-ever keynote to announce the Robinhood Gold Card, a new 1% boost on Robinhood Gold deposits, and a reimagined Robinhood app

Today, we are hosting Robinhood Presents: The New Gold Standard, our first-ever keynote event where Co-Founder and CEO Vlad Tenev will unveil new product and feature updates live to Robinhood customers in New York City. Ten years in, Robinhood Presents: The New Gold Standard is yet another step forward in our company’s mission to democratize finance for all as we unveil our first credit card–the Robinhood Gold Card. The event is available to livestream on go.robinhood.com/presents at 7:15 pm ET on March 26 and will be available for replay.

“There’s always been special perks and opportunities reserved for the wealthy that make them even richer. It’s why we started Robinhood and gave our customers access to features like commission free trading and the 24 Hour Market,” said Vlad Tenev, Co-Founder and CEO of Robinhood. “Today’s announcements at Robinhood Presents: The New Gold Standard bring us one step closer to the goal of giving everyone better access to the financial system,” said Tenev.

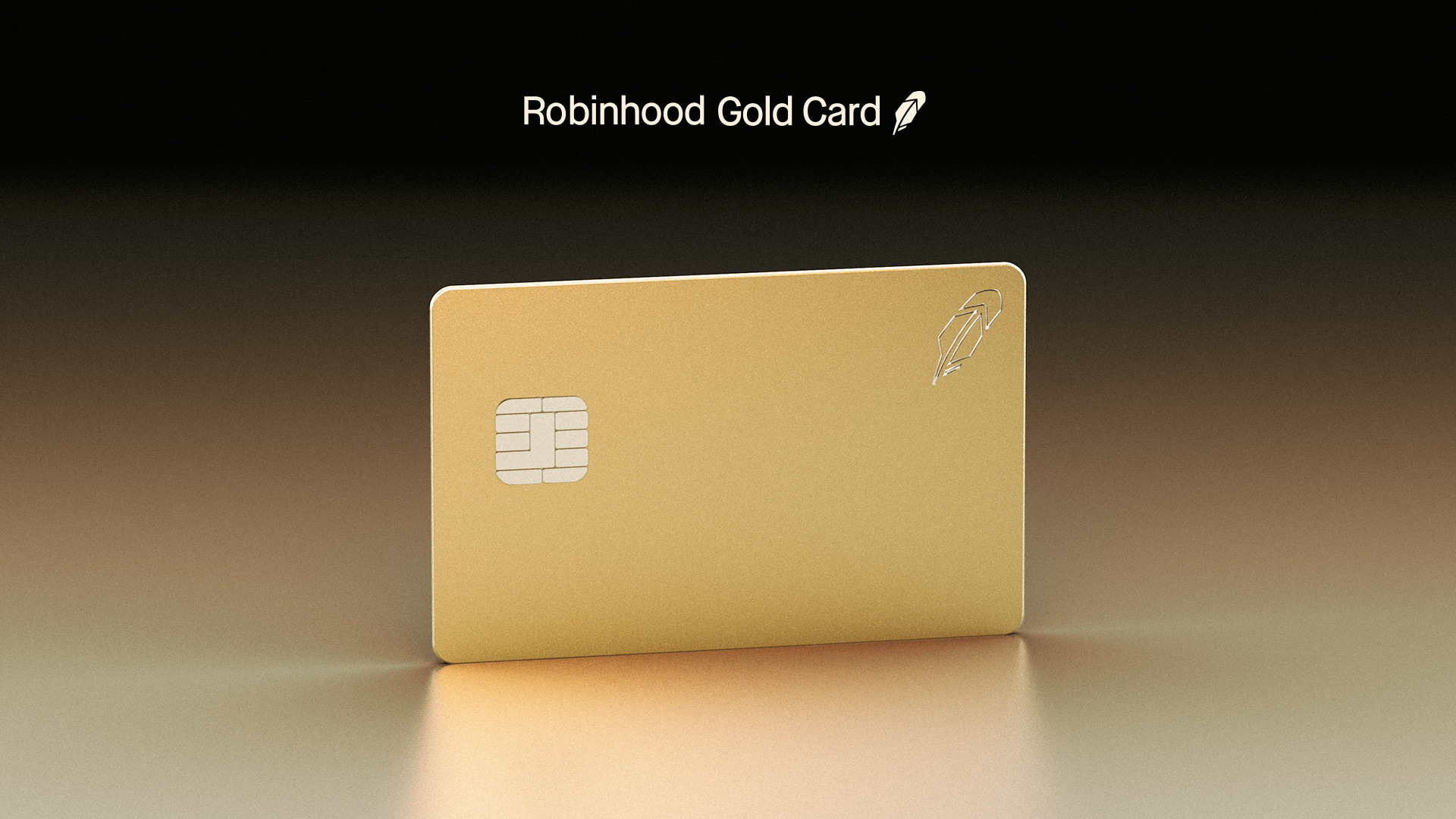

Introducing the Robinhood Gold Card

The Robinhood Gold Card is the only credit card you’ll need, and it’s exclusively for Robinhood Gold members1. The Robinhood Gold Card has no annual fee1, no foreign transaction fees, and offers you an unrivaled 3% cash back on all categories2. You will also earn even more on travel, getting 5% cash back when you book through the all-new Robinhood travel portal. Your reward points are then redeemable for travel, giftcards, and shopping at major retailers such as Apple, Nike, Bloomingdales, and more. Points can also be redeemed as cash, which can then be instantly transferred to your Robinhood brokerage account to invest, earn interest4, or withdraw.

At Robinhood, we recognize the need for change. Over 80% of U.S. adults have at least one credit card, but people still find everything from rewards, credit card terms, fees, and interest rates overwhelming. The Robinhood Gold Card reimagines the credit card experience, making it easy for people to keep track of how they spend their money.

Here’s what else you can expect from the Robinhood Gold Card:

- Premium benefits and perks: Wherever you go, the Robinhood Gold Card has you covered with a number of benefits and protections, including: trip interruption reimbursement, purchase security, auto rental collision damage waiver, extended warranty protection, return protection, zero liability protection, Visa Signature Concierge Service, travel and emergency assistance, roadside dispatch, and more3.

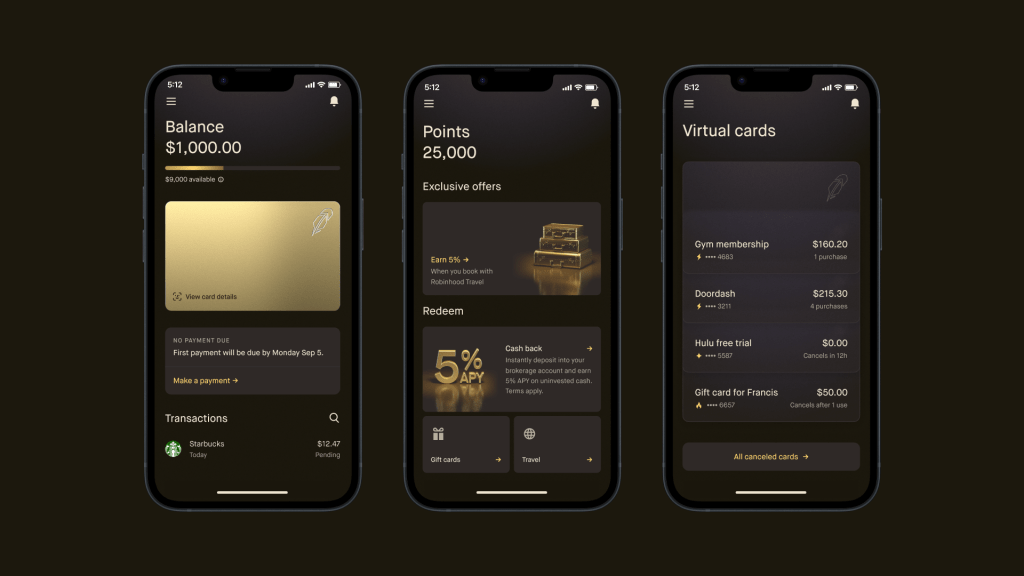

- Take control with virtual cards: With the Robinhood Gold Card, you can create virtual cards that allow you to pay with disposable card numbers for smarter, more private spending. Easily cancel subscription payments, end free trials automatically, authorize cards for one-time use, and get a new card right in the app if your physical card is lost.

- A card designed for the entire family: You can add up to five family members as cardholders to your account. Every cardholder receives their own card, and you can effortlessly track family spending, set spending limits, and lock lost cards instantly. Additional cardholders can be any age, making it a great way to build credit for the whole family.

- New app, same Robinhood: The Robinhood Gold Card works with a new app designed to change how you shop, spend, and manage your money: the Robinhood Credit Card app. The app makes it easy to visualize your spending patterns, make better informed decisions, and stay in control of your finances with access to real-time spending insights so you can track expenses, set up recurring payments, and use other key features highlighted above. It also works seamlessly with the Robinhood app, meaning you can switch between both without having to remember multiple log-ins.

- Refer friends, earn a solid gold card: Trust us, it’s worth the weight… if you refer 10 friends who sign up to Robinhood Gold, you’ll earn the solid gold Robinhood Gold Card – weighing 36g and made from real 10 karat gold. Terms apply.

You can reserve your spot on the Robinhood Gold Card waitlist today, with broad availability expected later this year.

All the Benefits of Robinhood Gold:

The Robinhood Gold Card is exclusively for Robinhood Gold members. In addition to the card, as a Gold customer you’ll also receive:

- 5.0% APY on uninvested cash, one of the best interest rates available in the country4.

- Up to $2.25 million FDIC insurance offered at a network of partner banks, higher than any one bank.

- 3% match on Robinhood Retirement IRA contributions, the first and biggest IRA match on the market5.

- A lower margin rate to boost your buying power, if eligible.

- Professional research from Morningstar and Level II market data from Nasdaq.

- Bigger instant deposits–up to $50K per day.

We remain focused on passing value back to our customers so their money works for them. Since we know Robinhood customers find a lot of value in our match offering, today we’re also introducing a new benefit: beginning in early May, Gold members will receive a 1% unlimited deposit boost on all incoming brokerage deposits, with no cap6.

You can try Robinhood Gold for a subscription fee. Visit robinhood.com/gold to learn more.

A Brand New Robinhood:

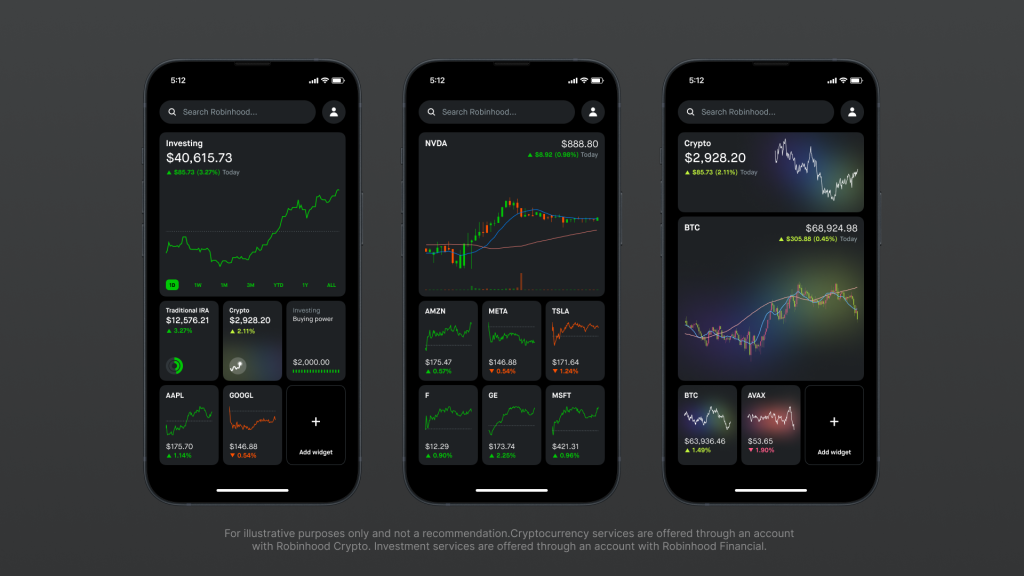

And we’re not stopping there. We’re also excited to announce an entirely new look and feel is coming to the Robinhood app. Our products and features today are more diverse than ever. We offer ways to invest, invest for retirement, tools for the advanced trader and more – this means our customers’ needs are more diverse than ever, too. The redesigned Robinhood app offers the most cutting edge experience in mobile investing, with a new homepage and tools such as customizable widgets so customers can make Robinhood work for their individual needs. We’re looking forward to sharing more with our customers later this year.

Although it’s been 10 years since Robinhood was founded, it’s only just the beginning of our story. We built Robinhood to be a new kind of financial services company—one aimed at helping everyone build toward their financial goals. To hear more about this vision from our Co-Founder and CEO, Vlad Tenev, join us for Robinhood Presents: The New Gold Standard at 7:15 pm ET on March 26, and be sure to follow us on X at @RobinhoodApp for all the latest.

Disclosures:

Robinhood Gold Card is offered by Robinhood Credit, Inc., and is issued by Coastal Community Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Robinhood Credit, Inc. (RCT), is a financial technology company, not a bank.

Individual credit limits will vary by applicant and are subject to credit approval and underwriting. See if you’re approved with no impact to your credit score. Your credit will not be impacted unless you decide to accept the card offer.

1See full rates and fee details. The Gold Card requires an annual Robinhood Gold subscription to apply and maintain the card and does not include a 30 day free trial. Robinhood Gold is offered through Robinhood Financial LLC (RHF) and is a subscription offering premium services for a fee. RHF (member SIPC) is a registered broker dealer. RCT and RHF are subsidiaries of Robinhood Markets, Inc. (Robinhood).

2Some limitations or conditions may apply. Must have Robinhood Financial brokerage account to redeem cash back. See rewards program terms for details. Rewards program terms are subject to change.

3See Visa benefits terms for details.

4The Brokerage Cash Sweep Program is an added feature to your Robinhood Financial LLC brokerage account. Interest is earned on uninvested cash swept from your brokerage account to program banks where it becomes eligible for FDIC insurance up to $2.25 million or $250,000 per program bank, inclusive of any other deposits you may already hold at the bank in the same ownership capacity which may impact how much is covered. Robinhood is not responsible for monitoring the amount of your deposits in any program bank, whether these deposits are made through the brokerage cash sweep program or otherwise, to determine whether the amount on deposit exceeds the limit of available FDIC insurance. Please note that until funds are swept to a program bank, they are held in your brokerage account which is protected by SIPC. Once funds are swept to a program bank, they are no longer held in your brokerage account and are not protected by SIPC. However, these funds are eligible for FDIC insurance through the Program Banks subject to FDIC insurance coverage limits. Please see the IntraFi Sweep Agreement for more information on how the sweep program works and how we treat your uninvested cash balance. Program banks pay interest on your swept cash, minus any fees paid to Robinhood. As of November 15, 2023, the Annual Percentage Yield (APY) that you will receive is 1.5%, or 5% for Robinhood Gold members. Terms apply. The APY might change at any time at the program banks’ discretion. Additionally, any fees Robinhood receives may vary and is subject to change. Neither Robinhood Financial LLC nor any of its affiliates are banks.

5Based on match dollars awarded to an IRA. The 3% matching on contributions requires a subscription with Robinhood Gold (fees apply), must be subscribed to Gold for 1 year after your contribution to keep the full 3% match. You must have compensation (wage income) in order to contribute to an IRA. The funds that earned the match must be kept in the account for at least 5 years to avoid a potential Early IRA Match Removal Fee. For more information refer to the IRA Match FAQ.

6Deposit boost is divided into 24 monthly payouts. To earn your full boost, hold or invest your brokerage deposits for 2 years. If you cancel Gold, you’ll lose future payouts you haven’t earned yet.

All investments involve risk and loss of principal is possible.

Other fees may apply. View Robinhood Financial’s fee schedule at rbnhd.co/fees.

There are additional, unique risks with trading outside of regular market hours you should be aware of before making an investment decision, including the risk of lower liquidity, increased volatility, greater spreads, and pricing uncertainty. Please review the Extended Hours Trading Disclosure for more information concerning these risks. The Robinhood 24 Hour Market is from Sunday 8PM ET – Friday 8PM ET.

For margin enabled customers, to earn interest through the cash sweep program, a cash balance is needed. If you have a margin balance, there is no cash balance to earn interest. Margin borrowing increases your level of market risk, as a result it has the potential to magnify both your gains and losses. Before using margin, customers must determine whether this type of strategy is right for them given their investment objectives and risk tolerance.

Bigger instant deposits are only available if your instant deposit status is in good standing.

Tickers shown in visuals are for illustrative purposes only, not a recommendation, and were selected from a group of the 2 largest S&P 500 companies within the top 11 sectors based on market cap, as of September 13, 2023.

Robinhood Credit, Inc. (RCT), is a financial technology company, not a bank. Robinhood Financial LLC (member SIPC), is a registered broker dealer. Robinhood Securities, LLC (member SIPC), is a registered broker dealer and provides brokerage clearing services. Cryptocurrency services are offered through an account with Robinhood Crypto, LLC (NMLS ID 1702840). Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. All are subsidiaries of Robinhood Markets, Inc. (‘Robinhood’).

Cautionary Note Regarding Forward-Looking Statements

This blog post contains forward-looking statements, including with respect to the expected benefits and timeline for general availability of the Robinhood Gold Card, and our plans to offer a new customizable homepage. Our forward-looking statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause our actual future results, performance, or achievements to differ materially from any future results expressed or implied in this blog post. Factors that contribute to the uncertain nature of our forward-looking statements include, among others, our limited operating experience at our current scale, the difficulty of managing our business effectively and the risk that changes in business, economic, or political conditions that impact the global financial markets, or a systemic market event, might harm our business. Because some of these risks and uncertainties cannot be predicted or quantified and some are beyond our control, you should not rely on our forward-looking statements as predictions of future events. More information about potential risks and uncertainties that could affect our business and financial results is included in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, as well as our other filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Except as otherwise noted, all forward-looking statements are made as of the filing date of this blog post and are based on information and estimates available to us at this time. Except as required by law, we assume no obligation to update any of the statements in this blog post whether as a result of any new information, future events, changed circumstances, or otherwise. You should read this blog post with the understanding that our actual future results, performance, events, and circumstances might be materially different from what we expect.

Robinhood, 85 Willow Road, Menlo Park, CA 94025.

© 2024 Robinhood. All rights reserved.

RO 3473957