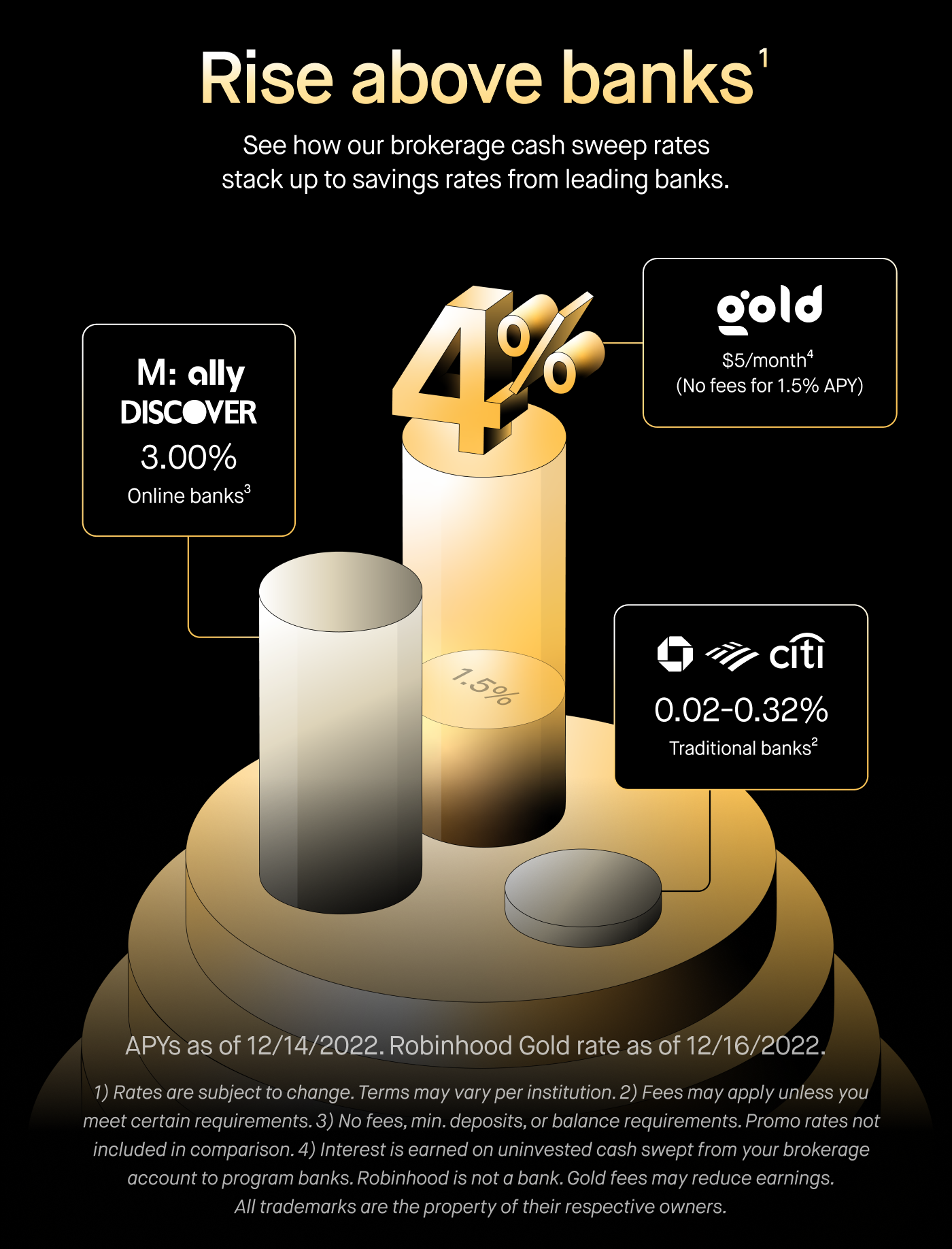

We did it again. Now earn 4% APY with Robinhood Gold

Robinhood is raising interest rates once again for Gold members. Earn 4% beginning Friday, December 16. Your first 30 days are free, then it’s just $5 a month.

The Fed just announced interest rates are going up again, but many banks are likely going to keep that extra cash for themselves. Unlike some of our competitors, we’re doing what’s best for customers by passing those savings along, which is why we’re once again raising our Robinhood Gold rate–this time to 4%. It’s our highest rate yet and is 21x more in interest when compared to the national average savings rate,* making it one of the best rates available.

The new interest rate goes into effect on Friday, December 16, at which time new and existing Gold customers enrolled in cash sweep can earn even more income on their uninvested cash, with no cap. Whether it’s that end of year bonus or cash gift, or putting extra money to work, customers can now take advantage of even higher interest rates while they plan their next move.

The interest compounds daily (derived from the 4% APY) and is then paid out monthly, with customers able to track how much they’ve earned directly within the app. Customers can also instantly transfer funds from their brokerage account into their spending account to make purchases using their Robinhood Cash Card.

All eligible customers who opt in to brokerage cash sweep have their uninvested brokerage account cash automatically “swept,” or moved, into deposit accounts at a network of six program banks. The cash deposited to these banks is covered by FDIC insurance up to a total maximum of $1.5 million (up to $250,000 per program bank, inclusive of deposits customers may already hold at the bank in the same ownership capacity). These banks will pay interest on the swept cash.**

This week’s new rate is on top of Robinhood Gold’s other benefits including:

- Bigger Instant Deposits. With Gold, customers can get $5,000 – $50,000 of their deposits instantly so they can invest right away.***

- Margin investing at 7%. Customers can borrow money to increase their buying power, if eligible.****

- Real-time market data. Customers can see people’s bids and asks on securities with Level II market data from Nasdaq.

- Professional research. Customers can plan their next move with stock research by financial analysts at Morningstar.

Customers can try Robinhood Gold for just $5 a month and new Gold subscribers will receive a free 30-day trial. Those not enrolled in Robinhood Gold can still earn 1.5% interest for all uninvested brokerage cash once enrolled in cash sweep.

Gold Cash Sweep balances are up by over $3 billion since we first increased rates in September.

20221214-2639614-8385093

*As of December 7, 2022 based on data from Bankrate the average interest rate for savings accounts was 0.19% and is subject to change. Bankrate obtains rate information from the 10 largest banks and thrifts in 10 large U.S. markets. Savings account interest rates vary from bank to bank and may be lower or higher than the stated average.

**The current APY enrolled customers will receive from these banks is 1.5% for non-Gold members and will be 4% for Robinhood Gold members as of December 16, 2022. Please note, for margin enabled customers, in order to earn interest, a cash balance is needed. If you have a margin balance, there is no cash balance to earn interest. Interest rates for cash sweep and margin investing can change at any time

***Bigger Instant Deposits are only available if your Instant Deposits status is in good standing.

****Margin interest rates are as of December 15, 2022. These are floating rates and are subject to change.

Disclosures: All investments involve risk and loss of principal is possible.

Banks listed for comparison were selected based on the top 3 in total assets in their respective categories (online and traditional banks) from FDIC.gov. Rates shown are the average APY across all balance tiers offered in savings accounts as of 12/14/2022: Marcus: 3% (Promo not included in comparison chart: 1% bonus for 3 months for each referral, up to 5 referrals per calendar year); Ally: 3%; Discover: 3%; Chase: 0.02%; Bank of America 0.025%; Citibank 0.32%. Rates subject to change at any time.

The brokerage cash sweep program is an added feature to your Robinhood Financial LLC brokerage account. Robinhood Gold is offered through Robinhood Financial LLC.

Interest is earned on uninvested cash swept from your brokerage account to program banks. Program banks pay interest on your swept cash, minus any fees paid to Robinhood. As of December 14, 2022, the Annual Percentage Yield (APY) that you will receive is 1.5%, or 4% for Gold customers as of December 16. The APY might change at any time at the program banks’ discretion. Additionally, any fees Robinhood receives may vary and is subject to change. Neither Robinhood Financial LLC nor any of its affiliates are banks.

With the brokerage cash sweep program, the uninvested cash in your brokerage account (cash intended for investing but that you have not yet invested or spent) is swept to program banks, where it becomes eligible for FDIC insurance up to $1.5 million or $250,000 per program bank, inclusive of any other deposits you may already hold at the bank in the same ownership capacity which may impact how much is covered. Please note that until funds are swept to a program bank, they are held in your brokerage account which is protected by SIPC. Once funds are swept to a program bank, they are no longer held in your brokerage account and are not protected by SIPC. However, these funds are eligible for FDIC insurance through the Program Banks subject to FDIC insurance coverage limits. Please see the IND Disclosures for more information.

Member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org.

Not all investors will be eligible to trade on margin. Margin involves the risk of greater investment losses. Additional interest charges may apply depending on the amount of margin used. Before using margin, customers must determine whether this type of strategy is right for them given their investment objectives and risk tolerance.

Robinhood Financial charges a standard margin interest rate of 11% and a margin interest rate of 7% for customers who subscribe to Gold. The margin interest rate is calculated by adding 7% (for non-Gold customers) or 4% (for Gold customers) to the upper bound of the Target Federal Funds Rate, which is set by the Federal Reserve and is subject to change without notice. The formulas used to calculate the margin interest rate are subject to change at Robinhood Financial’s discretion. The margin rates shown will go into effect on December 16, 2022 and might change at any time without notice and at Robinhood Financial’s discretion. The standard margin interest rate will be rolled out to customers who do not subscribe to Gold in phases over a period of time, subject to eligibility criteria, and so may not be available immediately to all customers.

Morningstar is not affiliated with Robinhood Markets, Inc. or its subsidiaries.

Spending account is offered through Robinhood Money, LLC (“RHY”) (NMLS ID: 1990968), a licensed money transmitter. Please see a list of our licenses for more information. The Robinhood Cash Card is a prepaid card issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. RHF, RHY, and RHS are affiliated entities and wholly owned subsidiaries of Robinhood Markets, Inc. RHF, RHY, and RHS are not banks.

Robinhood Financial LLC (member SIPC) is a registered broker dealer. Robinhood Securities, LLC (member SIPC) is a registered broker dealer and provides brokerage clearing services. All are subsidiaries of Robinhood Markets, Inc. (Robinhood).

© 2022 Robinhood Markets, Inc. Robinhood®